The reward will discontinue and be lost for periods wherein you don't pay back by automated deduction from a savings or checking account. Autopay just isn't needed to get a loan from SoFi. Immediate Deposit Lower price: Being eligible to probably acquire an extra (0.25%) curiosity charge reduction for starting direct deposit with a SoFi Examining and Personal savings account offered by SoFi Bank, N.A. or qualified cash management account made available from SoFi Securities, LLC (“Immediate Deposit Account”), you have to have an open Direct Deposit Account within just thirty times of your funding of the Loan. At the time suitable, you'll obtain this lower price in the course of intervals through which you've got enabled payroll direct deposits of a minimum of $one,000/month to your Immediate Deposit Account in accordance with SoFi’s realistic techniques and demands to generally be determined at SoFi’s sole discretion. This price reduction are going to be misplaced for the duration of intervals by which SoFi determines you may have turned off immediate deposits to your Direct Deposit Account. You aren't necessary to enroll in direct deposits to receive a Loan.

Other documents that may be essential by your state, including proof of profits, evidence of residency, or a sound car registration

LoanCenter has funded more than $five million in loans, above in excess of 20 years in enterprise. You can obtain both motor vehicle title and personal loans in this article, in the event that you would like some adaptability in excess of the way you borrow the cash you'll need.

Mesa is residence to 3 of our ten places, a point we choose Substantially delight in. We’ve expended ten+ several years Within this great town and also have not only watched its development, cash now title loan but sustained it through serving to our shoppers.

If you can’t repay the loan, the lender retains your title, properly using possession of the automobile by means of repossession.

We have been then inspired to provide them with a simply call to continue the process. The first time, the decision dropped. The next time, we were requested to leave a voicemail concept, Regardless that the decision was for the duration of typical organization hrs.

Max Cash is without doubt one of the farthest-achieving automobile title loan services on our listing, available to inhabitants of 38 states. That's not about they accustomed to go over (forty nine states, the last time we evaluated this corporation), but which is par for your study course during the market: states alter their guidelines and laws continuously, so it's unlikely you will discover a company that actually works in all 50 states. Just make sure that you live in on the list of sites exactly where Max Cash can fund your automobile title loan.

Using an auto title loan, the process can from time to time take as minor as an hour or so, particularly when you merely use on line. We’ve streamlined our procedure in the last decade to make it as fast as is possible to fix your fiscal situation.

Execs One among the bottom credit history score minimums all over Don’t always require a credit rating to qualify Commonly doesn’t need you to file paperwork No fees for paying out off loan early Drawbacks Larger-than-average utmost origination fee (0.

Armed service service members as well as their dependents can acquire some defense within the high APR of a title loan. The Military Lending Act limits the APR a lender can demand to 36% for loans with conditions of 181 times or less.

You will have to turn into a member in the credit union and might need to possess earnings directly deposited into the account. Cost your bank card

You’ve got a vehicle, but you will need some cash, and you need it now. The good thing is, a Title Loan is often a sort of cash progress that usually takes your clear car title and turns it into a loan, allowing you to obtain the cash you would like.

(47) Consumer Rankings & Opinions Scores and reviews are from serious customers who may have utilized the lending associate’s products and services.

In the long run, if you don’t repay the loan, the lender can repossess your automobile and market it to deal with the loan volume.

Luke Perry Then & Now!

Luke Perry Then & Now! Romeo Miller Then & Now!

Romeo Miller Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Talia Balsam Then & Now!

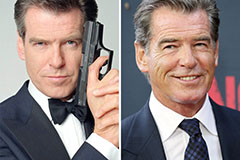

Talia Balsam Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!